As a freelancer, managing your finances is as crucial as landing your next client.

I mean, if you don’t have your finances in order, you won’t know who is paying for what and who to invoice.

It’s time to figure out which accounting software you should use.

The right accounting software not only simplifies invoicing and expense tracking but can also provide valuable insights into your business health.

Two giants in the field, FreshBooks and QuickBooks, often come up in the search for the perfect financial companion.

But which one suits your freelancing needs best?

Let’s dive deep into a comparison, or vs between FreshBoooks and Quickbooks.

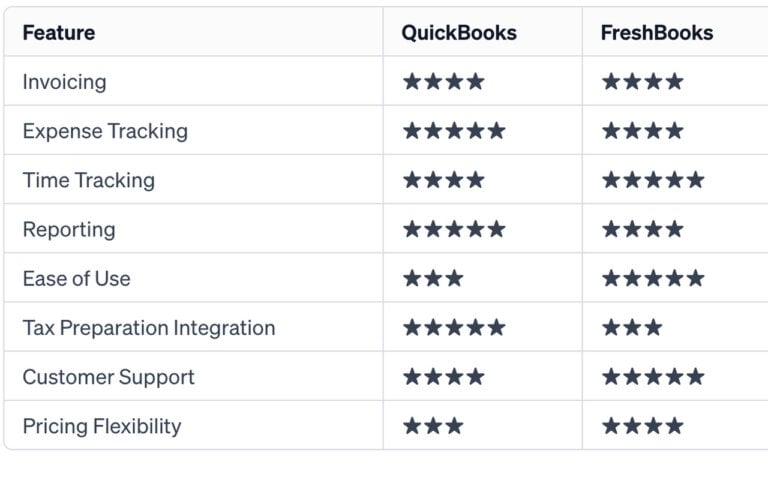

At a Quick Glance

Here’s a quick glance comparing different features of FreshBooks and QuickBooks online.

Using an Accounting Software App

As someone who is constantly diving into the client work, deadlines, and creativity, it’s easy to let the financial side of my business get unnoticed.

Yet, managing your finances effectively is as crucial to your success as delivering stellar work.

This is where accounting software can elevate your freelance business.

Imagine seamlessly tracking every invoice, expense, and payment with just a few clicks, transforming what once was a daunting task into a smooth, manageable process.

An accounting tool not only keeps your financial health in check but also liberates you to focus on what you do best: creating and delivering value to your clients.

It’s not just about keeping the taxman at bay; it’s about gaining insights into your business’s financial flow, enabling you to make informed decisions that steer your freelance venture towards growth and stability.

In a nutshell, incorporating an accounting software into your freelancing toolkit is not just a smart move—it’s a game changer.

So, let’s compare these two accounting softwares so you can make the right decision.

Ease of Use

How easy is it to learn these software programs?

I don’t know about you, but if it takes several Youtube videos, a PDF guide and training prompts to learn how to use either Quickbooks or FreshBooks, I may not choose them.

FreshBooks: Designed for Freelancers

FreshBooks stands out for its user-friendly interface designed with non-accountants in mind.

It’s billing is pretty simple and easy to use making it best for freelancers that don’t have complex billing.

Its dashboard is intuitive, making navigation through various features like invoicing, expense tracking, and time tracking seamless.

For freelancers who prioritize straightforward software that minimizes the learning curve, FreshBooks is a clear winner.

FreshBooks also integrates nicely with third-party apps like Stripe, PayPal, Asana, Trello, Expensify, Toggl and much more!

QuickBooks: A Steeper Learning Curve

QuickBooks, for self-employed business owners, is a very popular and well known accounting software program.

It offers a more comprehensive suite of features, which comes with a slightly steeper learning curve.

One thing I enjoy is the QuickBooks simple start. This is an entry-level edition of QuickBooks Online, Intuit’s cloud-based accounting software designed for small business owners and freelancers.

This version is tailored to those who are just beginning to manage their business finances and need a straightforward, user-friendly solution to help them track income, expenses, and prepare for tax time

But, for freelancers that want that extra level of features, QuickBooks is well known for integrating with other necessary third-party apps.

- E-Commerce Platforms: QuickBooks integrates with popular e-commerce platforms like Shopify and BigCommerce, allowing freelancers who sell products online to easily track sales, expenses, and inventory in real time.

- Payment Solutions: It supports integration with payment processors like PayPal, Square, and Stripe, facilitating smooth and secure transactions. This means freelancers can effortlessly send invoices and receive payments directly through the platform, streamlining the billing process.

- Time Tracking: For freelancers who bill by the hour, QuickBooks integrates with time tracking tools like TSheets, enabling users to accurately track and bill for their work hours.

- CRM Systems: Integration with Customer Relationship Management (CRM) systems such as Salesforce helps freelancers maintain their customer information and interactions in one place, providing a holistic view of client relationships.

- Expense Management: QuickBooks connects with apps like Expensify, simplifying the process of tracking and categorizing expenses, which is crucial for managing cash flow and preparing for tax season.

- Bank and Credit Card Accounts: Perhaps one of its most significant features is the ability to link directly to bank and credit card accounts, automating the bookkeeping process by importing transactions automatically. This reduces manual data entry and helps ensure financial records are accurate and up-to-date.

It’s incredibly powerful once mastered, especially for those with some accounting knowledge or businesses poised for growth.

However, for freelancers looking for simplicity, it might feel overwhelming at first.

Features

Now, I’m sure you want to know what the best features are for each accounting software, right?

Let’s check out how each app matches up see what their best accounting feature is.

Invoicing and Expense Tracking: A Tie

Both FreshBooks features and Intuit QuickBooks excel in invoicing and expense tracking, offering robust features that include

- customizable invoices

- automatic reminders

- easy expense categorization

The difference lies in the user experience, with FreshBooks being more straightforward and QuickBooks offering more depth in functionalities.

Time Tracking and Project Management

FreshBooks has a slight edge in time tracking and project management, particularly for service-based freelancers.

Its built-in time tracker and third-party apps like Toggl and TimeCamp and project management tools are more integrated into the overall user experience, making it easier to bill for time or manage projects directly from the dashboard.

QuickBooks, while offering time tracking, tends to be better suited for those who need detailed accounting features rather than comprehensive project management tools.

Pricing

But, what about pricing?

Which app is the best priced software for you?

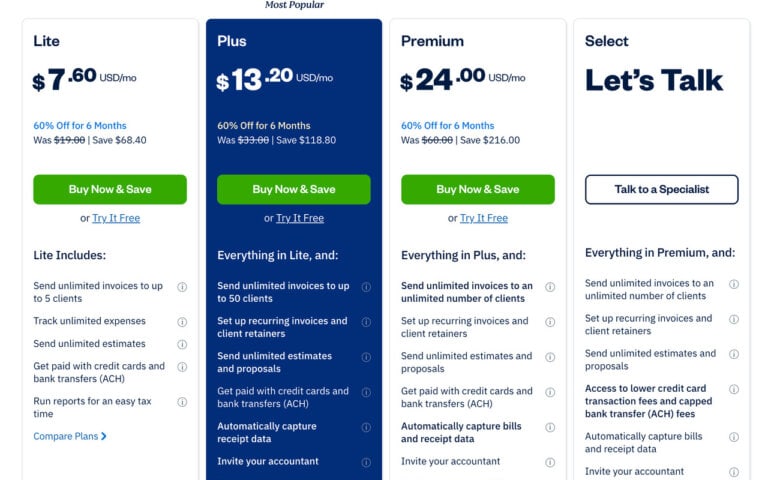

FreshBooks: Flexible Plans for Growing Businesses

FreshBooks payments offers several tiered pricing plans (FreshBooks Lite for example), starting from a lower price point ideal for freelancers and small business accounting.

The flexibility to upgrade as your business grows – without paying for features you don’t need – makes it an attractive option for those just starting out or managing a smaller client base.

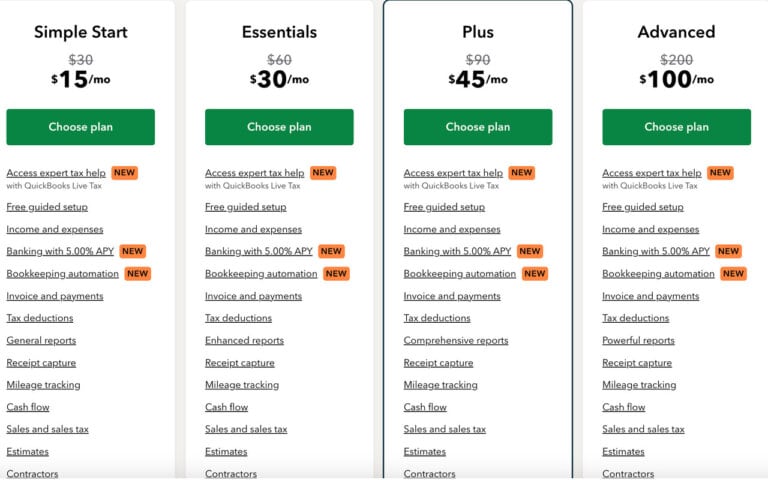

QuickBooks: Comprehensive Accounting at a Higher Cost

QuickBooks pricing reflects its comprehensive suite of features, generally coming in at a higher cost, especially for the plans that include full accounting capabilities.

They do, however, offer a free 30 day trial.

For freelancers whose businesses require extensive accounting support, this might be a worthwhile investment.

1 Comments